Right now interest rates for purchases (and refinances) are very low. Though the $8K tax credit is a big contributor to the improved market conditions we are experiencing, the low interest rates actually do more for affordability and buying power. Yesterday, with a client, we looked closer at why interest rates are low right now, and why they will go up in 2010.

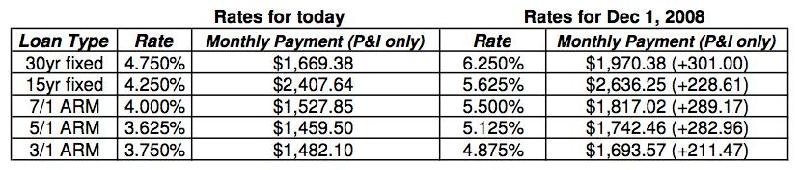

This case study based on a 400k purchase with 20% down and 1% loan fee (Loan amount $320K). All third party and other costs will be constant for illustration purposes.

In terms of buying power, an increase in interest rate from 4.75% (current levels) up to 6.25% (late 2008 levels) will cost about $62k in purchase price for the same monthly payment in this scenario. The same payment = $400K versus $338K purchase price.

Rob McAllister (West Seattle Mortgage) explains the recent history of interest rates:

*In December of 2008 the FED announced they would begin purchasing mortgage bonds to help push rates lower and allow people to purchase homes at artificially low rates as part of their efforts to stimulate the housing sector of the economy.

*The mortgage bond purchase program was initially set to expire in July of 2009 after $700B of government funds were exhausted. Rates in June began to move from the mid-4’s (on a 30 year fixed mortgage) to the mid-5’s in a week’s time based on the anticipation of the FED’s program expiring.

*The FED then announced they were going to allot an additional $500B toward the mortgage bond purchase program to extend their efforts until the end of 2009. The FED has been actively purchasing mortgage bonds in 2009 which has kept rates around 5% for much of the year.

*Just last week the FED announced that they would extend the time they plan to continue their purchase plan until the end of the first quarter of 2010, although they did not allot any additional dollars to the plan. This indicates that they plan to phase out the program over a longer period of time to ‘soften’ the inevitable rise in interest rates as they exit the market. Though it should be a more gradual climb, rates will begin to go up based on normal market conditions (no government involvement).

Conclusion: Interest rates are as important as price (or more important) to factor into the home buying equation. We are here to answer any additional questions you have about this topic and hope you will call us as you consider your options.

Warm regards,

Domenica

Windermere Real Estate