5 Stats You Won’t Hear On The News…

We know that many of our clients are still concerned about whether buying or selling in this market is a good idea. As always, there are individual factors that affect each person’s situation, and making a move is a big decision in any market.

This being said, it’s important to keep the housing market in perspective and not be alarmed with the media’s need for a catchy “story” saying real estate is either booming or it’s busting. Here are some interesting statistics that give a slightly broader view of the housing market and the economy:

Fact #1:

Approximately 30% of all U.S. homes are free and clear and do not have a mortgage

FACT #2:

Of the 70% of households that have a mortgage, 96.15% are current in their payments, NOT in foreclosure.

FACT #3:

The U.S. Gross Domestic Product is more than the GDP of the next three countries combined.

FACT #4:

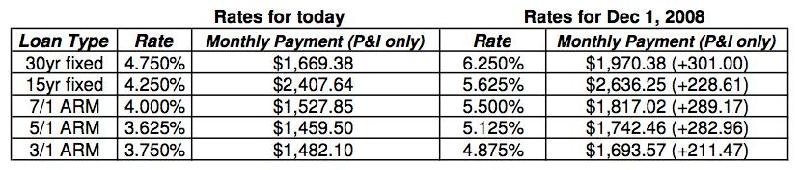

When mortgage rates fall to a record low, housing affordability surges to a record high.

FACT #5:

FACT #5:

The Housing Affordability Index is at the highest level of affordability in history.

This article from August in the Seattle Times talks more about our local affordability index rating.

This article from August in the Seattle Times talks more about our local affordability index rating.

There is still time to take advantage of lower home prices and historically low interest rates. Please feel free to call us anytime if you’d like to talk about this information and how it might relate to your situation.

Warm regards,

Domenica

Windermere Real Estate