Many buyers are considering whether to buy a home NOW or wait to see if prices come down a bit more. We wanted to clarify for our clients the most important variable in this equation: interest rates. The majority of buyers need financing to purchase their home. Interest rates are what buyers should be focused on, not prices.

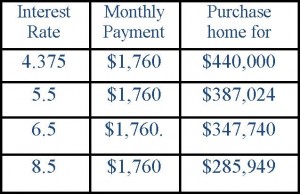

Here is an example that illustrates the point clearly, based on our listing at 3236 41st Ave SW offered at $440,000:

With 20% down and a credit score over 700 buyers currently qualify for a 30-year fixed rate loan with a rate of 4.375%. The monthly Principal and Interest (PI) payment on a loan of $352,000 at 4.375% would be $1,760.17.

If we adjust for interest rates rising while keeping the payment at $1,760.17/month and 20% down you can see how higher rates will affect your purchase power:

January 2008: 30-year fixed rate 5.5%. At that rate a payment of $1,760.17/month qualifies a buyer for a purchase price of $387,024.57. $52,975.43 less than today.

August 2008: 6.5% = purchase price of $347,740.75. $92,259.25 less than today.

May 2000: 8.5% = purchase price of $285,949.18. $154,050.82 less than today.

It is entirely possible that interest rates will climb to 8.5% within the next few years. While this is still a decent rate, historically speaking, you can see it makes a huge impact on a buyers buying power. It would take a 35% reduction in home values to make up for the $154,000 difference an 8.5% rate would make to buyers.

Today’s incredibly low interest rates have created an amazing opportunity for home-buyers, and we just wanted our clients to know.

Warm Regards,

Domenica

Windermere Real Estate