2009 Year In Review

A recap of the top stories in 2009:

2009-The year of the first-time home buyer

Supported by the tax credit and low interest rates, first-time buyers had an unprecedented showing in 2009 and helped to boost the struggling economy with their aggressive approach to the market. In the Seattle Metro area, 5950 homes sold in 2009 with an average DOM (days on market) of 59 days. 72% of those homes sold for less than $500,000, 52% sold for less than $400,000 (data from Northwest Multiple Listing Service).

Short sales and Foreclosures

Foreclosures, and the problems created by them, were among the most important stories of 2009. Coined “toxic assets” these homes were either sitting vacant or creating a flurry of paperwork as first-time buyers and investors competed to find the deal of a lifetime. Due to defaulting loans, foreclosures in 2009 helped cause the financial collapse, but by year’s end they were appealing to a growing segment of buyers. Overall, the foreclosure rate in Seattle has remained low compared to the National average.

Low interest rates

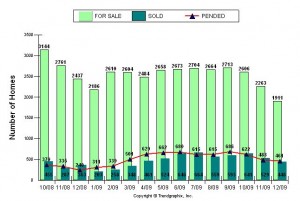

The rush to buy was due to a miraculous combination of factors. Interest rates continued to stay low, setting records as they fell against speculation. Low priced foreclosures and short sales, and the high inventory of homes on market brought prices down to affordable levels. Even the luxury market saw deep declines as sellers began driving prices way down. In 2009, interest rates stayed below 5.5% and in the 4% range for much of the year.

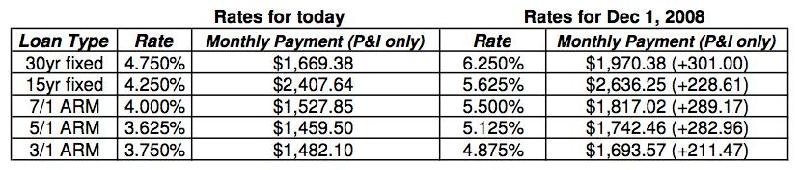

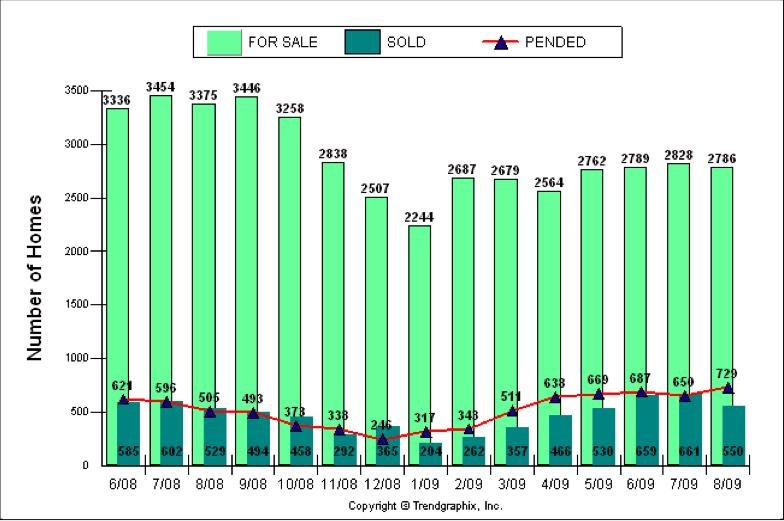

$8000 tax credit and the extended/expanded tax credit

Home sales continued to drop until the Fed stepped in and passed the $8000 tax credit for first-time home buyers. It took a few months to sink in and then sales shot up around mid-year to their highest levels in more than two and a half years. Slated to end on November 30, the tax credit was extended & expanded through April 30, 2010 to include homeowners buying their next home, if they’ve lived in their current home at least 5 years. The tax credit is one of the most important stories of 2009.

Below is a graph showing the sales activity for the past 12 months. The number of homes sold in 2009 is comparable to 2004, as well as median and average price. The average DOM for the homes sold last year was approx. 78 days, which is skewed high due to the increased length of time to sell short sales.

Warm Regards,

Domenica

Windermere Real Estate