Metropolist Magazine Volume 1 | Issue 1

Get Your Guide to the Hottest Real Estate Market in the Nation

Seattle’s real estate market, both residential and commercial, has been cooking for a few years, making it tough for people who want to enter the market, or even move within it. That’s where the 1st-ever Metropolist Magazine jumps in to inform.

Our 1st magazine is a 12-page guide packed with 2 main types of content, based on the last 6 months of market activity:

- Stories

- Data

Designed to easily inform and inspire you, this guide shares high-level data and professional insights about single-home, condominium and commercial sectors.

By neighborhood

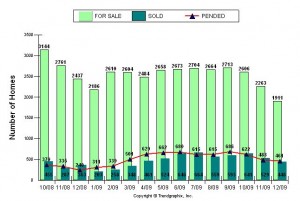

Also, we’ve broken the data out by neighborhood provided by NWMLS data and Trendgraphix. So, if you’re living in Ballard or University District, head over to page 9.

Also, we’ve broken the data out by neighborhood provided by NWMLS data and Trendgraphix. So, if you’re living in Ballard or University District, head over to page 9.

Curious about what’s been going on in West Seattle or Belltown? Those are on page 10, along with loads of other neighborhoods and districts. Fremont? Queen Anne? Madison Park? Yes, yes & yes….and more.

The color coded legend at the top of page 9 will make it a snap for you to understand at a glance.

Our aim?

Keep it simple, but provide great information around a large investment that directly affects the most important things in your life… your home, your family and your future.

Making the most of it

For best strategies and results, we suggest you ask your trusted broker to walk through this guide for more personal insights based on your own home and investment goals.

Whether you’re buying, selling or just checking in on the market, it’s time to download your 12-page Metropolist Magazine now.